Content of the article

- /01 What is LTV?

- /02 Why is LTV important for business?

- /03 Approaches to calculating and forecasting LTV

- /04 How to calculate LTV: formula and components

- /05 The relationship between LTV and CAC

- /06 Integrate LTV into your online marketing and SEO strategy

- /07 Challenges and risks when working with LTV

- /08 Practical recommendations and tools

LTV (customer lifetime value) is a key indicator in modern business that shows the total value of each user over the entire period of their interaction with the company. In this article, we will take a closer look at the concept of LTV and how to apply this metric to evaluate the effectiveness of marketing campaigns, optimize customer acquisition costs, and increase the profitability of business processes. The text also contains detailed examples that will help you easily integrate the LTV formula into your own analytics.

What is LTV?

LTV (lifetime value) is a complex indicator that reflects the total revenue or profit received from one user for the entire period of cooperation with the company. It takes into account not only a one-time purchase but also all repeat transactions, additional services, related products, and cross-selling. LTV is used to forecast long-term revenues, analyze the effectiveness of acquisition channels, and develop retention and personalization strategies.

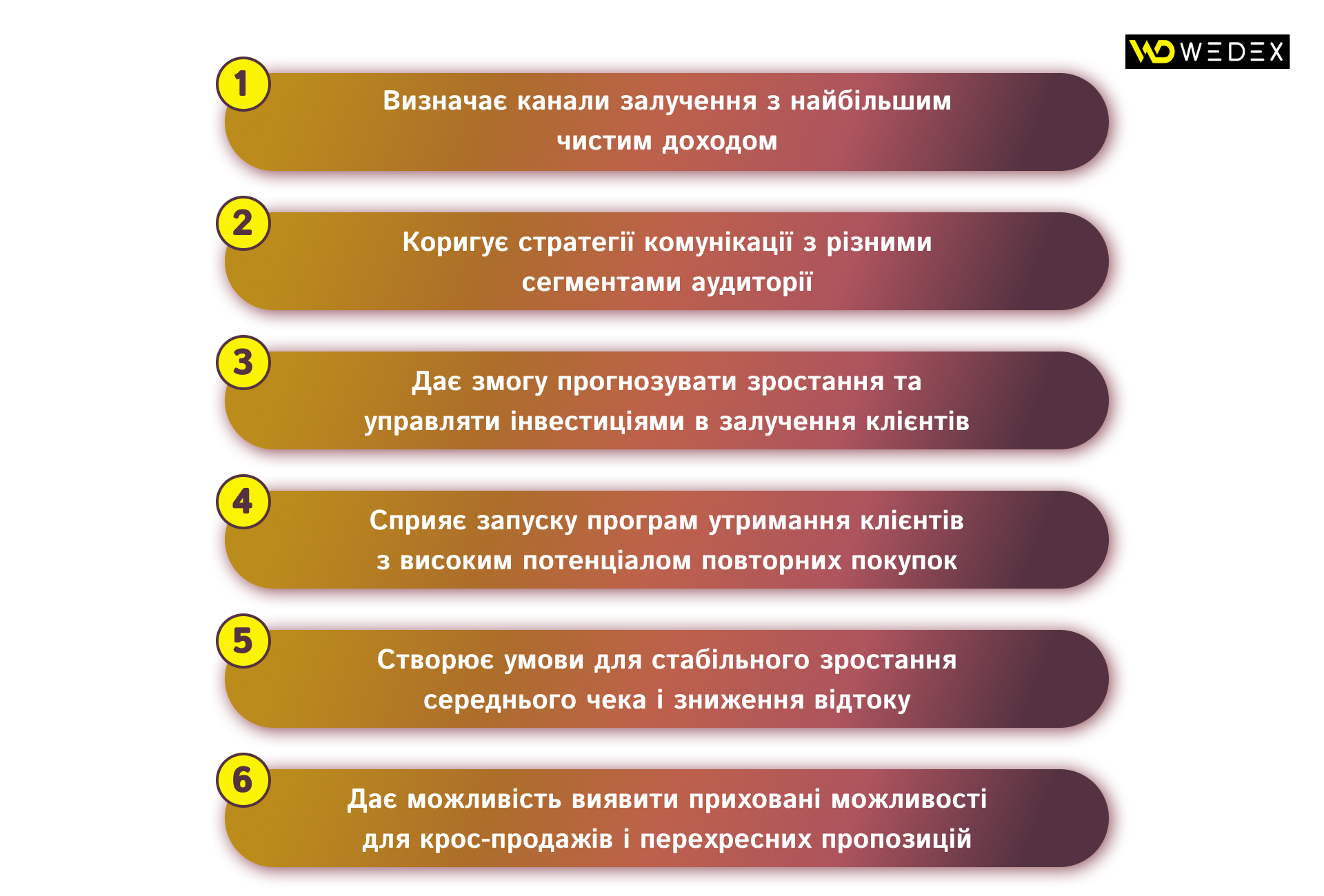

Why is LTV important for business?

LTV plays a key role in making informed marketing decisions.

Ultimately, this all increases the overall profitability of the business.

Approaches to calculating and forecasting LTV

Approaches to calculating and forecasting LTV are based on two main methods.

1. Historical analysis of LTV, when the metric is determined by actual data on customer behavior in the past. This approach gives a clear picture of the profitability and dynamics of LTV for companies with a relatively stable flow of orders, as all parameters are taken from real transactions.

2. Predictive LTV analysis using cohort and RFM analysis, as well as machine learning algorithms. This allows us to predict the potential income and future LTV of new and current users, taking into account seasonal fluctuations and changes in consumer activity. As a result, the predictive approach helps to quickly adjust marketing strategies and plan budgets with greater accuracy.

Historical analysis is usually chosen when a company has a sufficient amount of data over a long period and needs to accurately measure already established customer interaction patterns. Predictive analysis is useful for fast-growing projects or new markets where historical data is not available, as well as when you need to take into account the season or user behavior. In the case of a stable business model and low customer flow dynamics, the first approach is preferred, and the second one is used for aggressive scaling and adaptation to market changes. This choice allows you to combine the reliability of past LTV estimates with the flexibility of forecasting the future.

How to calculate LTV: formula and components

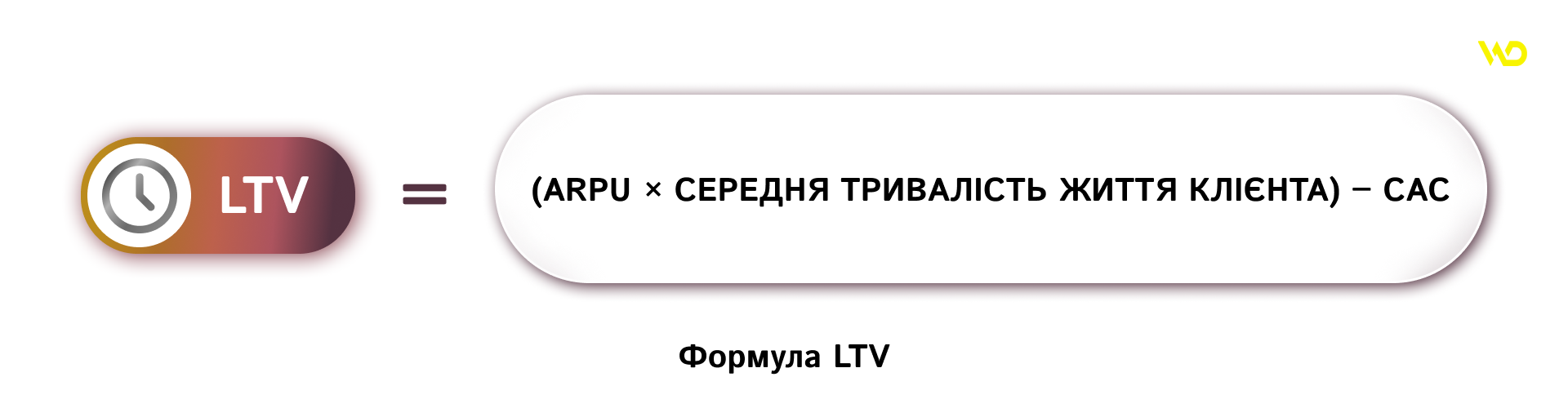

Simplified LTV formula for initial assessment:

Where:

- ARPU (Average Revenue Per User) – the average revenue from one customer for a certain period;

- average customer lifetime – in months or years;

- CAC – the average cost of attracting one new user.

The components of the LTV formula require careful customization. ARPU may differ depending on the segment: high-value customers have higher ARPU but often require higher maintenance costs. Lifetime value depends on the specifics of the product: in subscription services, it can be measured in years, and in retail – in several months. In general, CAC should be calculated separately for each channel (contextual advertising, social media, SEO, email newsletters).

Example of LTV calculation

Consider a subscription service that provides monthly access to content for a fee. Let’s assume that we have the following initial data:

- ARPU (Average Revenue Per User) – the average revenue from one customer per month is $25. This value includes both the basic monthly fee and additional purchases within the platform.

- Subscription Duration – the average user stays active for 24 months. This indicator reflects the average length of the subscriber’s life cycle from the moment of activation to the moment of cancellation.

- CAC (Customer Acquisition Cost) – the average cost of acquiring one customer is $200. This includes the cost of media buying ads, agency work, and internal marketing.

To estimate LTV, we first multiply ARPU by the customer’s lifetime:

|

Total lifetime revenue = $25 × 24 months = $600 |

We get the total revenue from one subscriber, excluding the cost of attracting them. Then we subtract the CAC from this amount:

|

LTV = $600 – $200 = $400 |

As a result, the net LTV is $400. This value means that each new user brings $400 in net profit to the business during the entire subscription period.

This calculation allows you to manage your advertising budget more flexibly. For example, if you aim for a LTV/CAC ratio of 3:1, then the allowable cost of attracting one customer should be no higher than:

|

Maximum CAC = LTV / 3 = $400 / 3 ≈ $133 |

In practical terms, LTV means that you can gradually increase your bids in Google Ads or other channels until the average cost per click and conversion is close to $133. After that, further bid increases risk reducing profitability.

The relationship between LTV and CAC

The relationship between LTV and CAC demonstrates how profitable it is to invest in attracting new customers. To calculate the indicator, you need to divide the total net revenue from the customer (LTV) by the cost of acquiring the customer (CAC). The resulting ratio immediately indicates whether the company earns more than it spends on marketing and how sustainable the chosen strategy is.

A value of less than 1:1 means that every dollar invested is partially returned, and the company is operating in the red. A ratio of 1:1 to 3:1 may be acceptable in the short term, for example, to quickly increase the user base in a new market. But without a further increase in LTV or a decrease in CAC, such a model will not withstand competition. The ideal ratio is considered to be 3:1 to 4:1, when a business receives stable profits and can invest in scaling. If LTV/CAC exceeds 4:1, it is a signal of the possibility of more active development: you can increase advertising budgets or try new channels without risking profitability.

The expected limits of the ratio may differ in different industries: in SaaS companies, where customer lifetime is measured in years, the permissible indicator may be slightly lower, and in e-commerce with a short purchase cycle, on the contrary, it may be higher. LTV/CAC analysis allows you to regularly check the effectiveness of advertising campaigns, adjust bids, and respond quickly to market changes. If the ratio falls, you should first optimize creatives and channels with high cost per acquisition or increase retention and upsell efforts to increase the lifetime value of each customer.

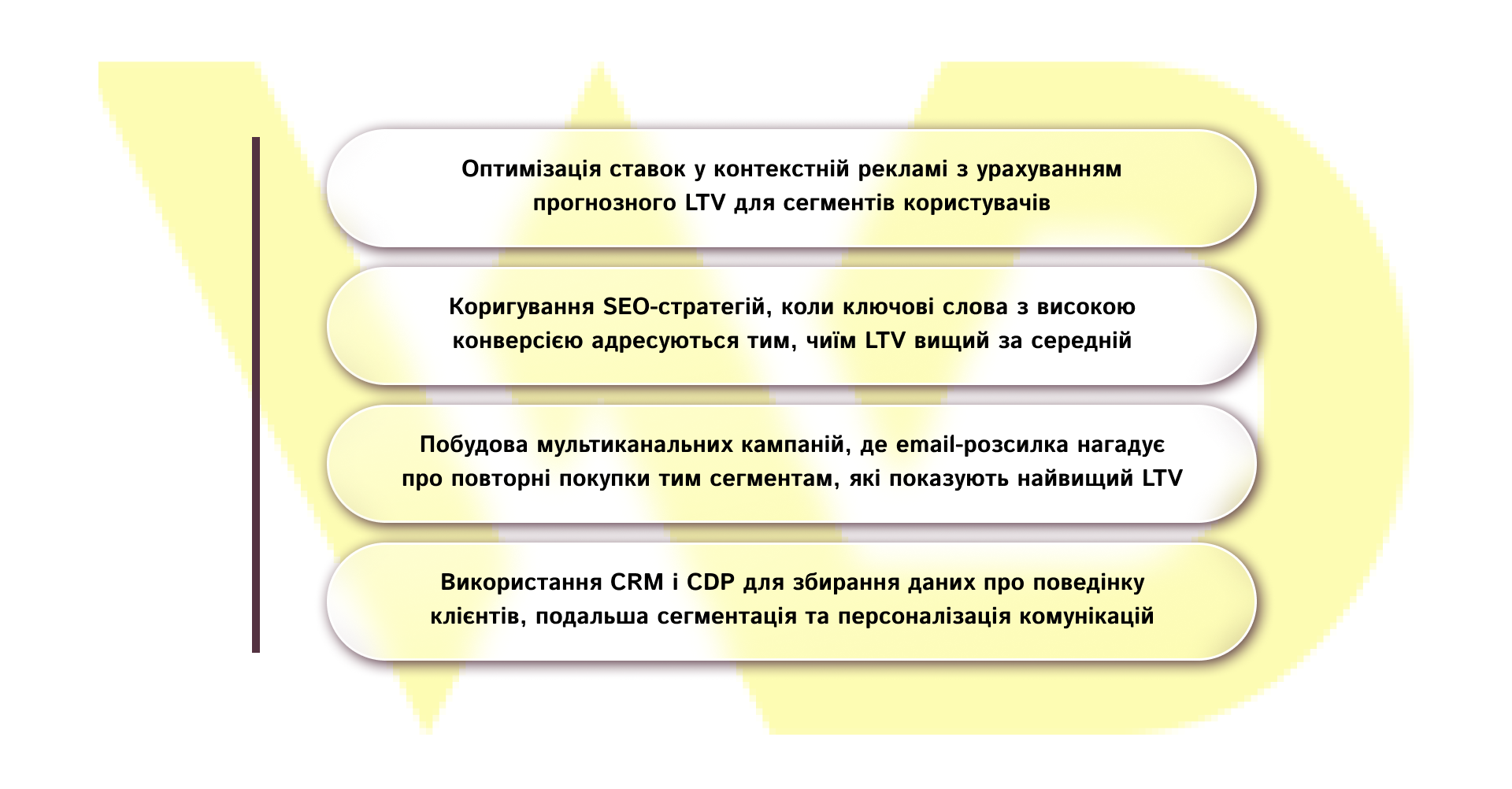

Integrate LTV into your online marketing and SEO strategy

LTV can be the basis for decision-making in the following areas:

Optimizing bids in contextual advertising

By dividing your audience into groups based on expected LTV, you can set higher bids for those users who have the highest potential for repeat purchases. For example, in Google Ads, you should set up separate campaigns for segments with an above-average LTV using the Target CPA or Target ROAS strategy with adapted target parameters. This allows you to avoid wasting your budget on low-potential audiences and increase your overall profitability.

Adjustment of SEO strategies

LTV analysis helps to identify which semantic cores not only drive traffic but also generate customers with the highest long-term value. As a result, it is worth strengthening the optimization of landing pages for these queries by preparing content with a greater focus on upsell and cross-sell, as well as implementing micro-markup to display ratings and reviews to increase trust and conversion.

SEO should focus on the quality of customers, not the number of visits.

We optimize your website for the queries and segments that bring in customers with high LTV. This way, you get not just visitors, but profitable customers.

Building multichannel campaigns

Using LTV data, you can create dynamic email series with personalized recommendations and special offers for the most valuable customers. For example, after three months of activity, the system automatically sends a promotional code or exclusive access to new products, which increases the average purchase frequency. This approach increases the lifetime value of the customer and reduces the likelihood of churn.

Using CRM and CDP to collect data

Integration of LTV into CRM/CDP allows you to create a single source of truth about each user: order history, interaction channels, and average life expectancy. Based on this data, automated flows are launched to increase loyalty, for example, offers for the customer’s birthday or special conditions for those who have reduced activity. Personalized messages via SMS, push notifications, or chatbots ensure better engagement and LTV growth in the long run.

Thus, integrating LTV into your online marketing and SEO strategy allows you to optimize costs, increase campaign efficiency, and ensure long-term business growth by targeting users with the highest revenue potential.

Challenges and risks when working with LTV

Implementing the LTV metric in business intelligence faces a number of challenges that can affect the accuracy of calculations and the practical benefits of this metric. Below are the main risks and ways to mitigate them.

- Inaccurate data.

Outdated or incomplete data on purchases and customer interactions distort ARPU and average lifetime value. For example, if the sales database does not contain information about additional services or cross-selling, LTV will be underestimated. To avoid this, it is necessary to regularly update data from all channels (CRM, ERP, website analytics) and validate records.

- Difficulty of forecasting for new businesses.

Startups that are just entering the market often lack historical data to calculate LTV, and any predictive modeling is based on a small sample. This increases the risk of erroneous estimates of customer life expectancy and, consequently, inaccurate forecasts. The recommendation is to combine short-term observations (for example, the first months of activity) with industry benchmarks and adjust LTV forecasts as data accumulates.

- Ignoring external factors.

Economic crises, seasonality of demand, or increased competition can suddenly change user behavior. If these changes are not taken into account, the LTV calculated on the basis of a «quiet» period will be incorrect. To reduce the risk, it is worth introducing time adjustments. For example, to analyze peak sales seasons and recession periods separately, as well as to monitor macroeconomic indicators.

Despite these challenges, a competent combination of a data collection system, adaptive forecasting, and regular monitoring of external conditions allows for reliable LTV indicators. This creates a solid basis for strategic planning and effective marketing decisions.

Practical recommendations and tools

To make your work with LTV effective and bring maximum business benefits, you should use proven methods and modern analytics tools.

Cohort analysis in Google Analytics or BI platforms

Instead of averaging indicators for all users, cohort analysis breaks down the audience by the time of the first interaction (week, month) and allows you to track their behavior in different periods. In Google Analytics, this is implemented through Cohort Analysis reports: you can see when customers return, what their retention rate is, and how their ARPU changes over time. On specialized BI platforms (we’ll look at them later), you can set up dashboards that not only visualize cohorts but also integrate data from CRM or ERP for a more complete picture.

Implementing a sales funnel in CRM

A sales funnel is a sequence of stages that a customer goes through from the first contact to a repeat purchase. You need to set up the following stages in the CRM system

|

lead → qualification → presentation → transaction → repeat purchase |

and record the probability of transition between them. This way, you can calculate the conversion at each step, assign the expected income to each stage, and eventually build a more accurate LTV module. This information allows you to identify bottlenecks in the process and optimize them.

Application of the RFM model for segmentation

RFM (Recency, Frequency, Monetary) is a simple but powerful approach to dividing customers into groups based on three indicators:

- Recency – how much time has passed since the last purchase;

- Frequency – how often a customer buys;

- Monetary – how much money they spend over a certain period.

Combining these data, you get segments with different LTV potential: «star customers», «risky», «catching up», etc. For each segment, you can develop your own marketing scenario, from VIP offers to reactivation campaigns.

Choosing tools with forecasting capabilities

When you need not only retrospective but also predictive analysis, pay attention to platforms with built-in ML analytics.

- Tableau allows you to customize forecasts based on time series;

- Power BI includes Quick Insights and Python/R support for custom models;

- Google BigQuery ML allows you to build linear and nonlinear models directly in the database using SQL queries.

Such solutions make it easier to automate LTV calculations, identify trends, and create «what-if» scenarios for budget planning.

Implementation of these recommendations will create a reliable analytical basis for customer acquisition and retention strategies, improve the accuracy of calculations, and make marketing more targeted and effective.

22/09/2025

22/09/2025  1530

1530